The Platform Worker Bill takes effect from 1 Jan 2025 and seeks to strengthen the protection for platform workers in three areas: (1) CPF contributions, (2) Work injury compensation (WIC)* (3) Platform work association representation.

More details can be found in the respective sections below.

CPF

Effective 1 Jan 2025, CPF contributions will be deducted from your platform earnings by Gojek and submitted to the CPF Board (CPFB) every month (if applicable).

If you are born on or after 1 Jan 1995

- CPF contribution is mandatory.

- Your CPF contribution, which includes both your share and Gojek’s share, will be allocated to all three CPF accounts (Ordinary, Special/Retirement, MediSave) to help grow your CPF savings and support your housing, retirement, and healthcare needs.

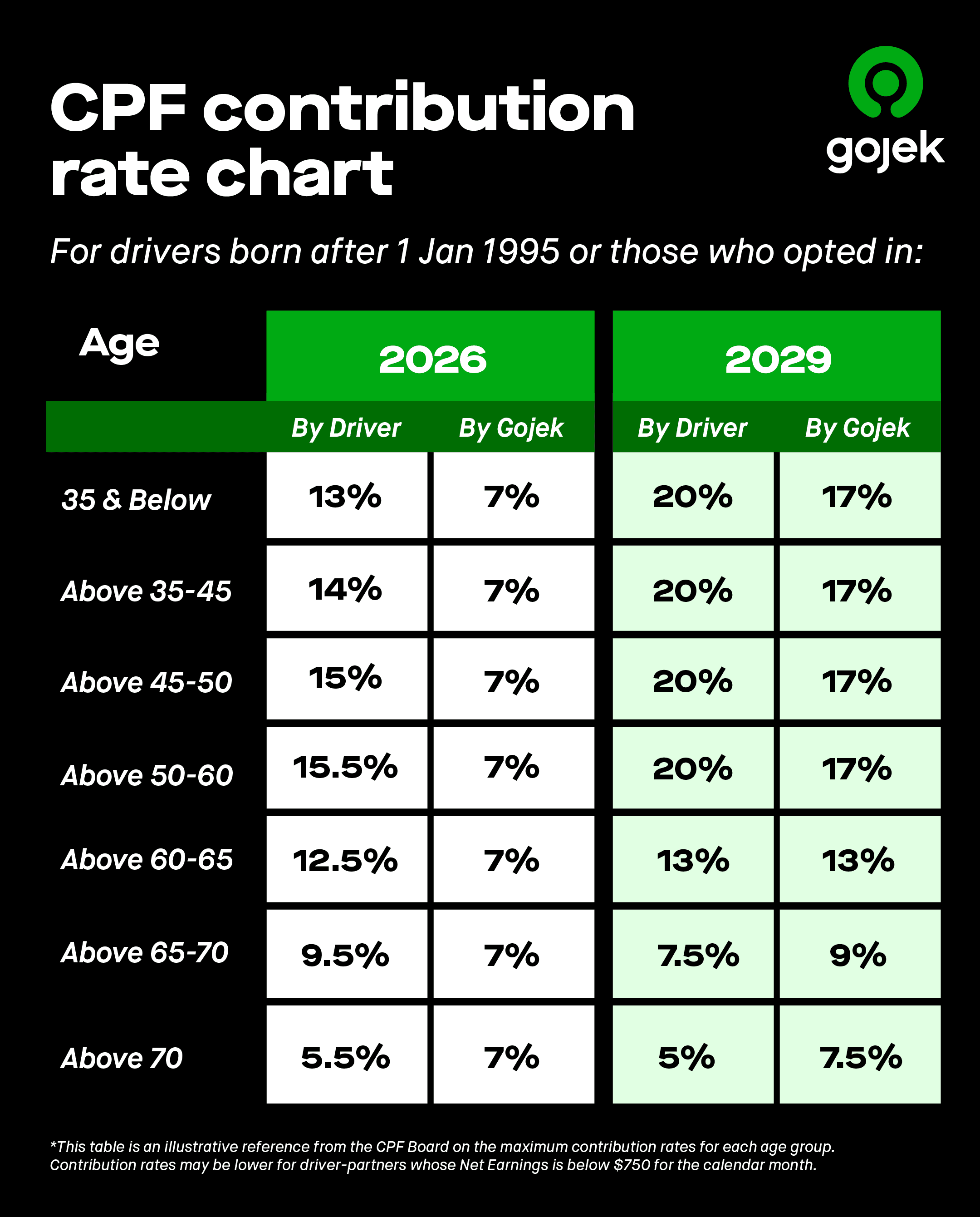

- The share of CPF contributions will gradually increase to align with employees and employers by 2029.

If you are born before 1 Jan 1995

- You have the option to opt in to contribute to all three CPF accounts (Ordinary, Special/Retirement, MediSave) but note that you CANNOT OPT OUT once you have made the decision.

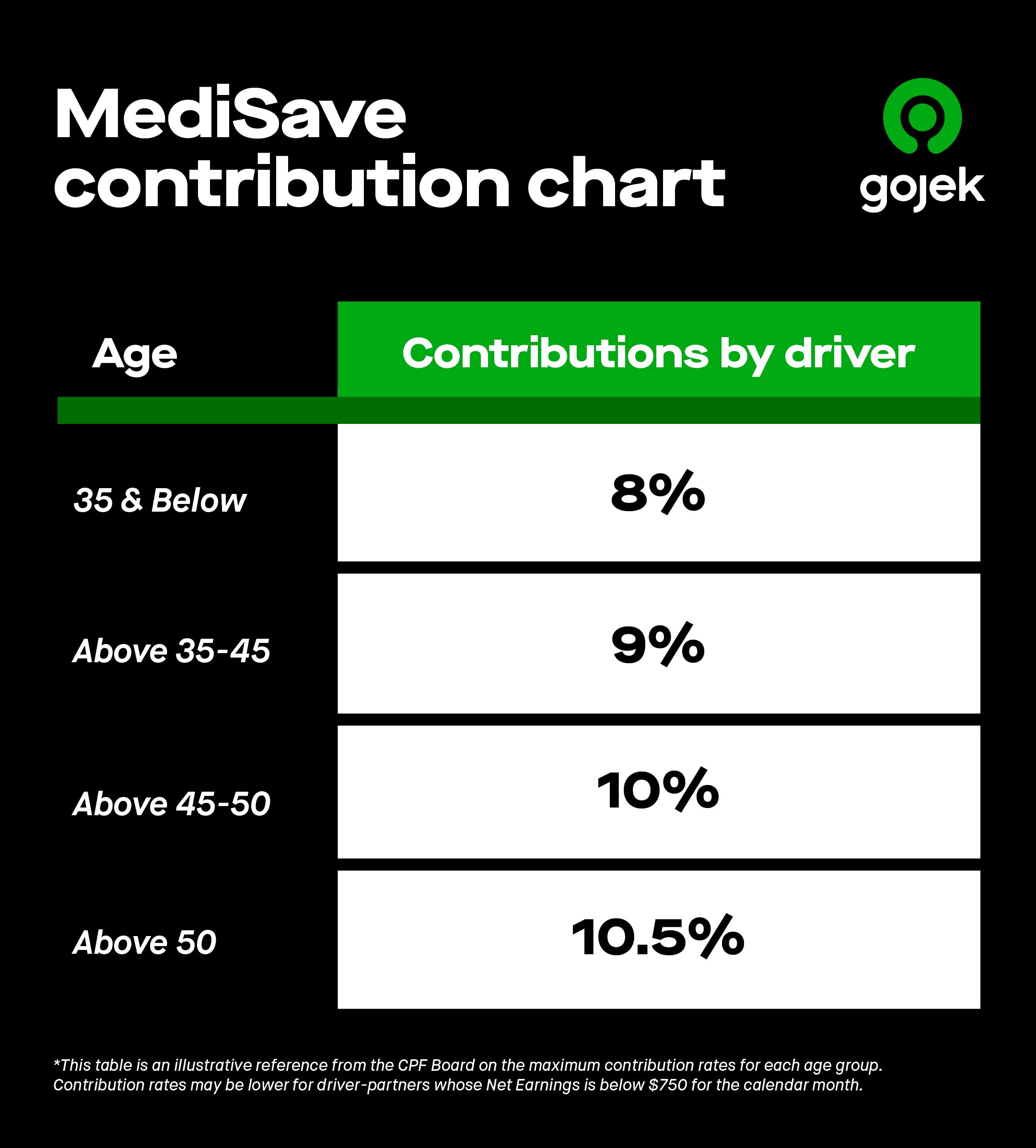

- If you do not opt in, you will continue to contribute to your MediSave account only. Gojek will also collect the Medisave contribution based on your earnings and submit it to the CPF Board on your behalf.

- If you want to opt in, you can do so via CPFB’s portal. There is NO deadline for opt-in.

- Your opt-in status will apply to all platform operators you drive with.

Do note that opting in to CPF contributions may lower your take-home earnings.

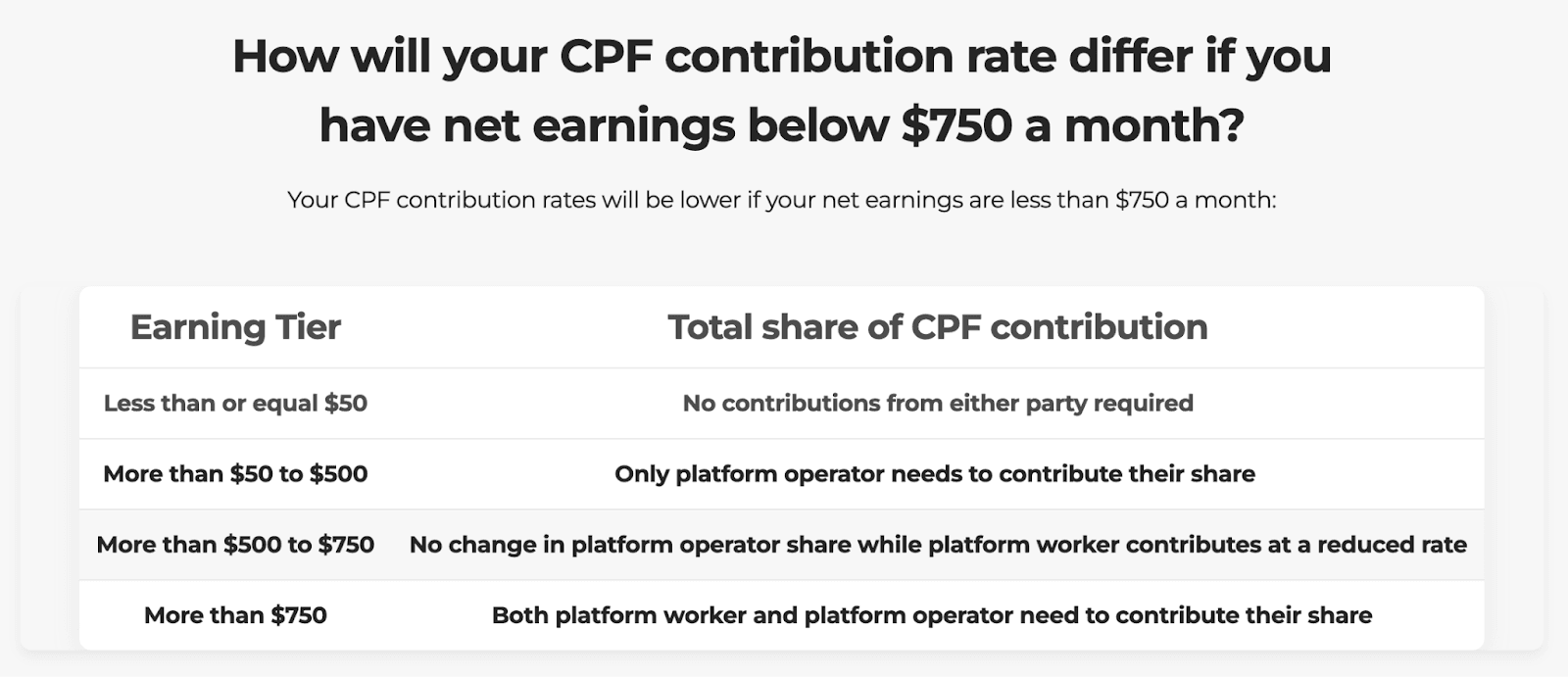

CPF contribution is based on net earnings

Net earnings = Gross earnings x (100% - Fixed Expense Deduction Amount of 60%)

Fixed Expense Deduction Amount (FEDA) is the sum of all allowable business expenses incurred in earning platform income and is fixed at 60% for cars.

*This table indicates the maximum contribution rates for each age group and is merely for reference. For your specific contribution, please use the link below. Contribution rates may be lower for driver-partners whose Net Earnings is below $750 for the calendar month.

🔗 Calculate your platform workers’ CPF contributions here: www.cpf.gov.sg/member/tools-and-services/calculators/platform-worker-cpf-contribution-calculator

How will Gojek collect and pay my contributions to CPF or MediSave?

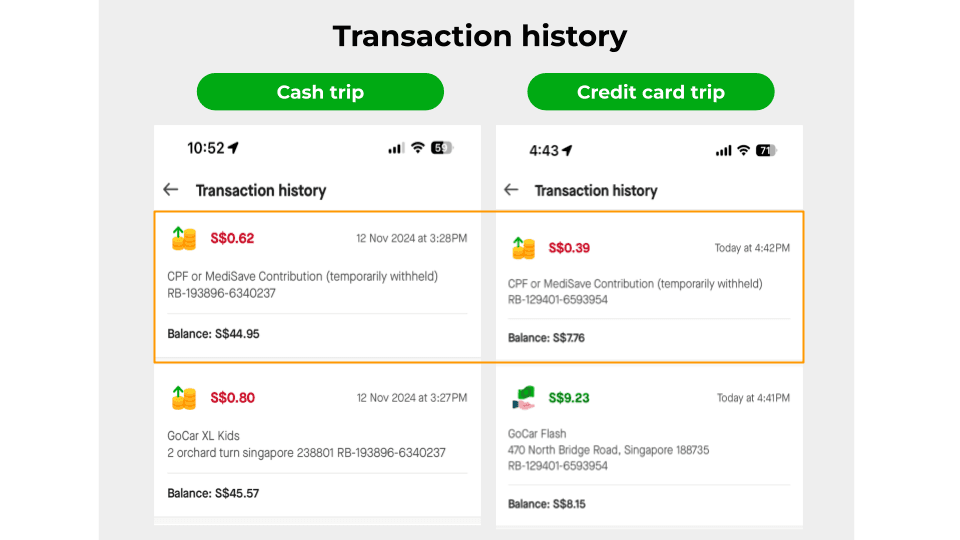

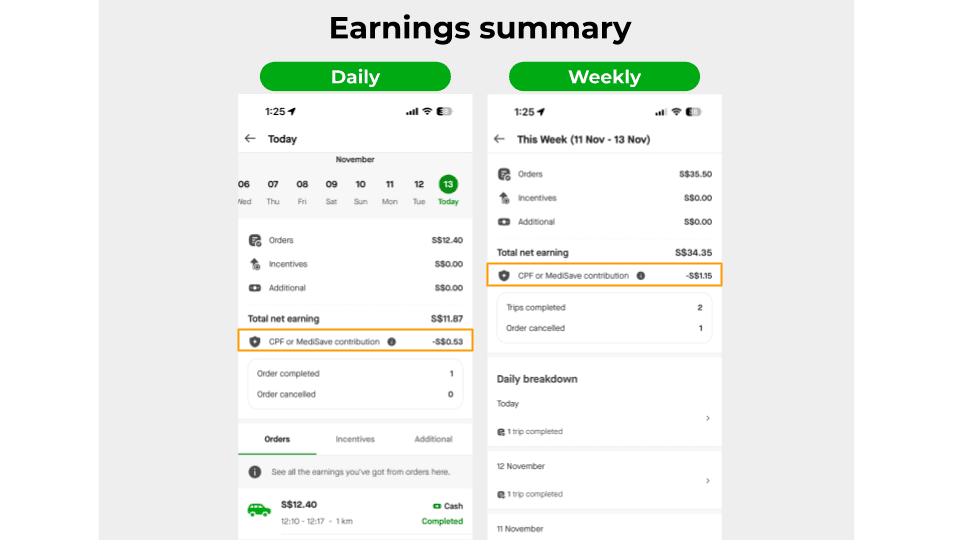

- Your CPF or MediSave contribution will be withheld for every trip or transaction (eg. incentives, tips) based on the maximum contribution rate for your age group. You will be able to see the amount withheld for CPF or MediSave in your Transaction History after each transaction is completed and can also find the total on the Earnings Summary screen.

- At the end of each month, we will determine your actual CPF contribution rate based on your total monthly net earnings. If the actual CPF contribution determined is lower than the CPF contributions collected, the excess contribution will be returned to your Earnings wallet by the 14th of the following month.

- Gojek will submit the actual contribution to the CPF Board in the following month, together with Gojek’s Platform Operator share (if applicable). You will receive a monthly statement that summarizes your total earnings as well as CPF or MediSave contributions by the 18th of the following month as well.

See examples below:

Platform Workers CPF Transition Support (PCTS)

Between 2025 and 2028, lower-income platform workers who are required to, or have opted in to make increased CPF Ordinary and Special Account contributions will receive monthly cash payments under the Platform Workers CPF Transition Support (PCTS) scheme. This helps to mitigate the impact of the increased CPF contributions on platform workers during this period of change.

🔗 Learn more about CPF contributions for platform workers here: www.cpf.gov.sg/member/growing-your-savings/cpf-contributions/saving-as-a-platform-worker

If you have any further questions, please contact CPFB at: https://www.cpf.gov.sg/service/write-to-us

Work Injury Compensation (WIC)

WIC is Work Injury Compensation* for accident-related injuries that have the same scope as employees under the WIC Act (WICA). It takes effect from 1 Jan 2025 and covers three components:

(1) Medical Expenses

(2) Medical Leave & Hospitalisation Leave

(3) Lump-sum Compensation for Death or Permanent Incapacity

*Note: WICA covers a wider range of compensations for work-related accidents and will therefore replace the existing free accident coverage for all driver-partners and Gigacover’s Freelancer Earnings Protection (FLEP) for Pro/Elite tier driver-partners from 1 Jan 2025.

CPF FAQs

[GOJEK-SPECIFIC - EARNINGS]

Q: Will my order allocation be affected if I opt-in for CPF contribution?

A: No, order allocation will not be impacted regardless of whether you opt-in to CPF or not.

Q: How will my earnings be affected if I opt in for CPF contributions?

A: Take-home earnings will be reduced by your CPF contribution amount (Platform Worker contributions). Overall total earnings will increase taking into account the Platform Operator (Gojek)’s CPF contribution.

Q: Will my GoalBetter tier impact my CPF contribution rate?

A: No, CPF contribution rates are determined by the CPF Board based on your age, net earnings and whether you have opted in.

Q: What are the components included in gross earnings that contribute to CPF?

Gross earnings include payments received for:

- Trip fares including driver service fee, waiting fee, edit destination fee, multi-stop fees

- Tips received from customers

- Incentives (Daily incentives, flash incentives, monthly incentives, far pick-up incentives, fuel rebates)

CPF contributions are not payable on:

- Reimbursements (eg. cancellation fee reimbursements, service recovery)

- Referral fee, engagement events

- ERP

Q: How is Gojek going to fund the Platform Operator’s share of CPF contributions?

A: Gojek’s contribution will not come from incentives or service fees. Instead, the contribution will be funded by an increase in platform fees. This helps to protect driver's earnings while enabling us to maintain and improve our services in support of the new Platform Worker Bil. This is automatically paid for by customers to Gojek.

Q: How will Gojek collect and pay my contributions to CPF or MediSave?

A: As the final % contribution can only be determined at the end of each month, Gojek will be collecting your CPF contribution at the maximum contribution rate for your age group as you earn.

- On a trip or transaction (eg. incentives or tips) basis, the maximum CPF contribution rate for your age group will be collected as you earn.

- At the end of the month, we will determine your actual CPF contribution rate based on your total monthly net earnings.

- If the actual CPF contribution determined is lower than the CPF contributions collected, the excess contribution will be returned to your Earnings wallet by the 14th of the following month.

- Gojek will submit the actual contribution to the CPF Board in the following month, together with Gojek’s Platform Operator share (if applicable).

The detailed breakdown will be reflected in your monthly earnings’ statements, which will be shared by the 18th of the following month as well.

Example:

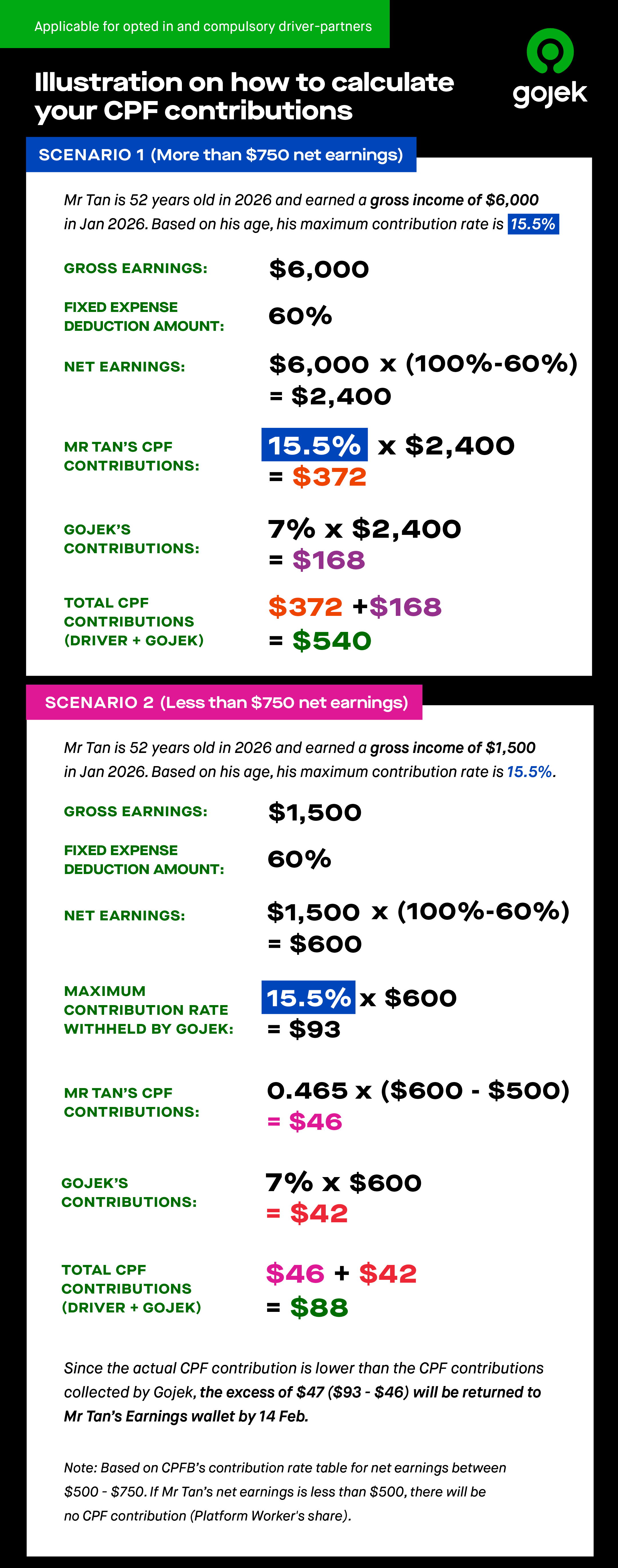

Scenario 1:

Mr Tan is 52 years old in 2026 and has opted in for CPF contribution. Mr Tan earns a gross income of $6,000 in Jan 2026. Based on Mr Tan’s age, his maximum contribution rate is 15.5%.

Mr Tan’s CPF contribution will be as follows:

Gross Earnings: $6,000

FEDR: 60%

Net Earnings: $6,000 x (100%-60%) = $2,400

Mr Tan’s (Platform Worker's) share of CPF Contributions: 15.5% x $2,400 = $372

Gojek (Platform Operator’s) share of CPF Contributions: 7% x $2,400 = $168

Total CPF Contributions (Driver + Gojek): $372 + $168 = $540

Scenario 2:

Mr Tan is 52 years old in 2026 and has opted in for CPF contribution. Mr Tan earns a gross income of $1,500 in Jan 2026. Based on Mr Tan’s age, his maximum contribution rate is 15.5%.

Mr Tan’s CPF contribution will be as follows:

Gross Earnings: $1,500

FEDR: 60%

Net Earnings: $1,500 x (100%-60%) = $600

Maximum contribution rate withheld by Gojek: 15.5% x $600 = $93

Mr Tan’s (Platform Worker's) actual share of CPF Contributions: 0.465 x ($600 - $500) = $46

Gojek (Platform Operator’s) actual share of CPF Contributions: 7% x $600 = $42

Total CPF Contributions (Driver + Gojek): $46 + $42 = $88

Since the actual CPF contribution determined is lower than the CPF contributions collected by Gojek, the excess of $47 ($93 - $46) will be returned to Mr Tan’s Earnings wallet by 14 Feb.

Note: If Mr Tan’s net earnings is less than $500, there will be no CPF contribution (Platform Worker's share).

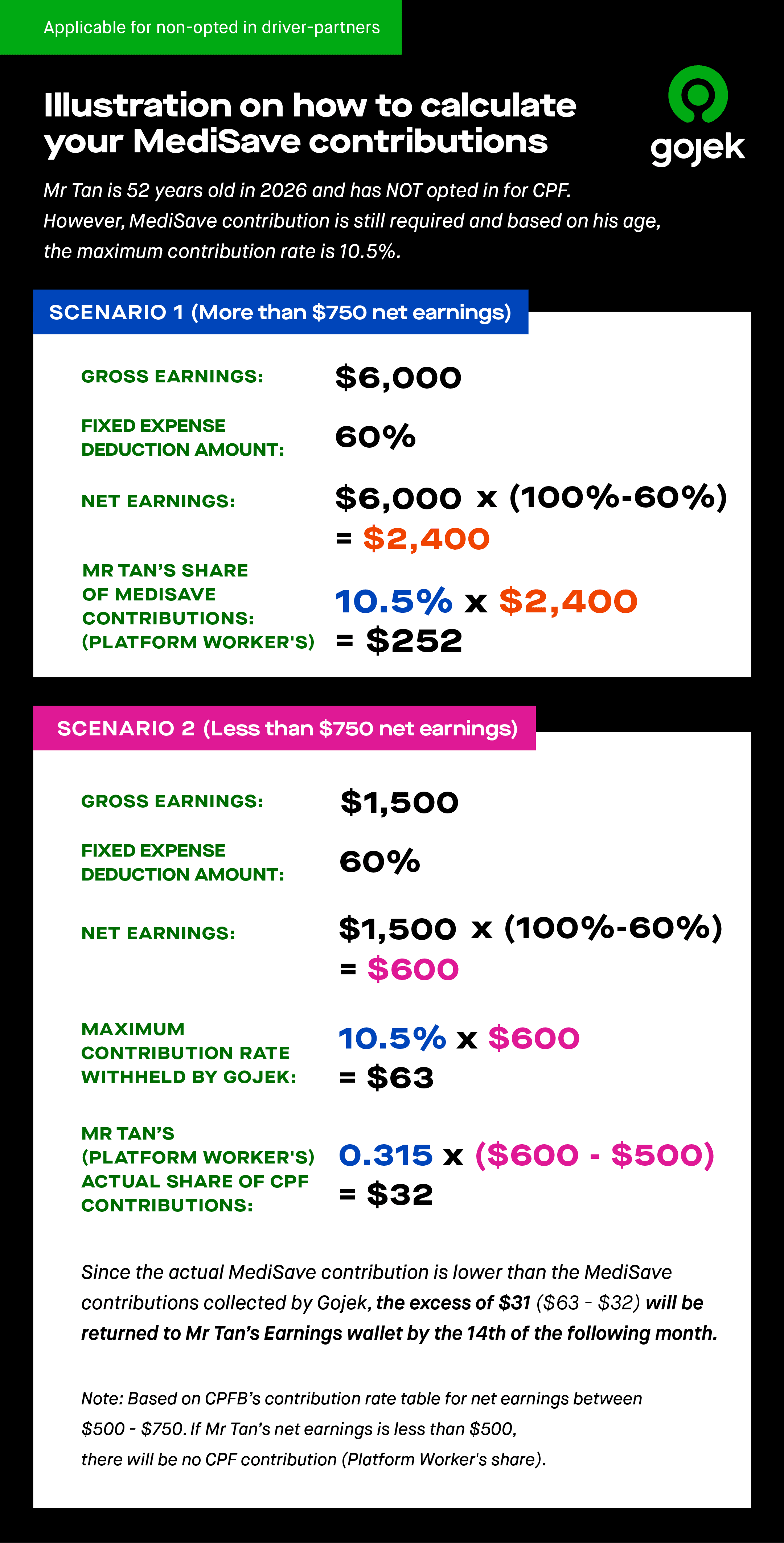

*If you do not opt-in for CPF, your MediSave contribution will be calculated and withheld in a similar method based on the maximum rate for MediSave. However, there will not be any Gojek CPF contributions if you do not opt-in.

Q: What will all the CPF or MediSave transactions look like for both driver and Gojek’s contribution?

A: You will see the total amount of CPF being withheld on a daily and weekly basis on your earnings summary screen.

In the following month, we will refund any excess amount based on your total monthly earnings by the 14th of the following month.

You will receive a monthly statement with details of your actual CPF contribution, including Gojek’s contribution.

[CPF OPT-IN and MECHANICS]

Q: How do I opt in for CPF and how soon will it take effect?

For those who are born on or after 1 Jan 1995, there is no need to opt-in as contribution is mandatory.

For those born before 1 Jan 1995, CPF contribution is optional for you. You may opt-in via the CPFB’s portal. While there is no deadline to opt-in, do take note that you will not be able to opt-out once you have done so.

If you opt in by the 15th of the month, you will receive CPF contributions from the following month. Otherwise, CPF contributions will be received from the 2nd month onwards.

As an example, if you opt-in on 15 Dec 2025, your CPF contributions will begin on 1 Jan 2026. However, if you opt-in on 16 Dec 2025, your CPF contributions will begin on 1 Feb 2026.

This cut-off date applies to all platform workers, including newly onboarded driver-partners.

Once opt-in is successful, you will receive a confirmation email and SMS from the CPFB.

Q: If I do not opt-in, do I still need to contribute to my MediSave account?

A: Yes, if you do not opt-in, you will continue to be required to make CPF MediSave contributions, but will not receive the platform operator’s share of CPF contributions.

Gojek will deduct only your share of MediSave contributions from your net earnings and submit these contributions every month to the CPFB. These will be allocated to your MediSave account only.

Your MediSave contribution will be calculated and withheld in a similar method based on the maximum rate for MediSave.

Q: Is there a monthly earnings ceiling for CPF contributions?

A: Monthly earnings ceiling does not apply to platform workers. However, there is an annual net earnings ceiling of $102,000 that applies on a per platform basis, and a CPF contribution limit of $37,740 per year.

Q: What are the contribution rates for platform workers?

A: Your CPF contribution rate depends on your earnings, age and opt-in status.

From 2025, the CPF contribution rates will gradually increase over 5 years to align with those of employees and employers, reaching up to 20% and 17% respectively by 2029.

You can verify your own contribution rates and amount using Platform Workers CPF Contribution Calculator. Do take note to use your Net Earnings (Gross Earnings eligible for CPF minus 60% FEDA) to calculate your contribution amounts.

Q: How do I calculate my CPF contribution amounts?

A: Your CPF contribution is calculated based on your monthly net earnings (after 60% FEDA - Fixed Expense Deduction Amount) and the contribution rate applicable to your age, calculated separately on a per platform basis, earnings and opt-in status on a platform.

EXAMPLE

Step 1: Determine your gross earnings eligible for CPF on Gojek for the month: $3,000

Step 2: Apply your Fixed Expense Deduction Amount (FEDA): 60% expense for cars

Step 3: Compute your net earnings: $3,000 x (100%-60%) = $1,200

Step 4: Key in your net earnings into Platform Workers CPF Contribution Calculator to find out your contributions and allocation.

*Note: Net Earnings eligible for CPF contributions is determined based on the above formula, and not just the Net Earnings after Service Fee deductions.

Q: What is Fixed Expense Deduction Amount (FEDA)? Can I just declare my expenses separately?

A: Your income that is subject to CPF will be computed based on earnings less a Fixed Expense Deduction Amount or FEDA.

For cars, FEDA is set at 60%, taking reference from the Fixed Expense Deduction Ratio developed by IRAS for the computation of net earnings for tax purposes. This is based on actual expense ratios, including industry feedback and surveys on the expenses of workers. The FEDA amount is deemed to be the sum of all allowable business expenses incurred (including but not limited to car rental, repairs, maintenance, fuel, EV charging, parking fees, platform service fees, ERP) in earning the driving income.

FEDA is applied to all platform workers to simplify the computation of CPF contribution for both platform operators and platform workers, regardless of income levels and delivery modes. As such, CPF contributions cannot be adjusted based on declared expenses.

Q: Is there any support provided during this transition period for CPF contribution?

A: Between 2025 and 2028, lower-income platform workers who are required to, or have opted in to make increased CPF Ordinary and Special Account contributions will receive monthly cash payments under the government’s Platform Workers CPF Transition Support (PCTS) scheme.

These payouts will be made directly by the government to your bank account - Gojek is not involved in this process.

Q: Do I need to apply for PCTS?

A: You DO NOT need to apply for PCTS as assessment is automatic.

🔗 Learn more about PCTS here:

cpf.gov.sg/member/growing-your-savings/government-support/platform-workers-cpf-transition-support

🔗 Calculate the amount you can receive from PCTS

www.cpf.gov.sg/member/tools-and-services/calculators/platform-workers-cpf-transition-support-calculator

If you have any further questions, please contact CPF Board at: https://www.cpf.gov.sg/service/write-to-us

[TAX-RELATED]

Q: Will tax filing procedures change with the inclusion of CPF contributions?

A: There will be no changes to the current tax filing procedures. Look out for more information towards the end of the year to opt in for the IRAS pre-filing scheme.

Q: Will I receive any tax relief for my CPF contributions?

A: Yes, IRAS will take your CPF contributions into account for tax relief.

WICA FAQs

Q: Who is eligible for WICA?

A: All driver-partners who transact on Gojek from 1 Jan 2025 are eligible for WICA for accident-related injuries.

Q: How do I make a claim?

A: Please inform Gojek about the accident and injury as soon as possible to allow us to assist on the claims. You can report the accident via your Gojek driver app > Help center > Safety & Emergency > I was in a car accident.

Our team will reach out for further details to follow up on submitting your claims. Please prepare the related supporting documents, such as Medical Certificate/s, medical bills/receipts, and police reports where applicable.

Q: If I get injured while working with Gojek, can I claim it under WICA and my personal insurance?

A: You will only be able to claim for 1 policy at a time. If you submit your accident claim through Gojek, we will submit your claim under WICA and you may submit to your other policies (if any) only after the claim exceeds the WICA limit.

Q: What types of compensation will be provided under WICA?

A: Platform workers will have the same scope and level of WIC benefits as employees including:

- Income loss compensation

- Medical expenses

- Lump sum compensation for permanent incapacity, current incapacity or death

However, compensation for light duties will not apply to platform workers. For more information, please refer to MOM’s website.

Q: Why does Gojek need to collect my personal, accident, and earnings data?

Gojek will need to collect and validate the information in order to submit an injury report (iReport) for a WIC claim in order for you to receive compensation for medical claims and earnings protection (where applicable). Please be informed that the process will be handled by Gojek, our Third Party Administrator (Jarvis Services Pte Ltd), and/or our Insurance Provider (Etiqa Insurance Pte Ltd).

For more details on the required data and information, please refer to MOM’s website.